Financial letter, Spring 2020, 51st edition

“The stock market is a device for transferring money from the impatient to the patient.”

– Warren Buffett

After recording its longest expansion on record, the global economy has fallen into a sharp recession as governments take unprecedented measures in an attempt to prevent a public health crisis. It is impossible to predict with certainty how the next 6 to 12 months will play out, as we are entering a totally unprecedented period in which medicine, not economics, will play the leading role.

Periods of economic contraction generally occur as a result of economic or financial imbalances. The current slowdown is different because it is the result of a single external event: the rapid spread of a dangerous and contagious virus.

The spread of COVID-19 has had far-reaching consequences for Canadians, the economy and the financial markets. The pandemic has led to the adoption of extraordinary public health measures and government action at an unprecedented scale. Like many other central banks, the Bank of Canada cut its key interest rate, which now sits at 0.25%. The US Federal Reserve cut its benchmark rate to zero. In Canada, the federal government has so far dedicated $105 billion to fight the pandemic. The United States passed a rescue package totalling more than $2 trillion (approximately 10% of GDP), an unrivalled amount that is significantly larger than the package put together in response to the 2008 financial crisis. Governments elsewhere in the world are also rushing to assist households and businesses.

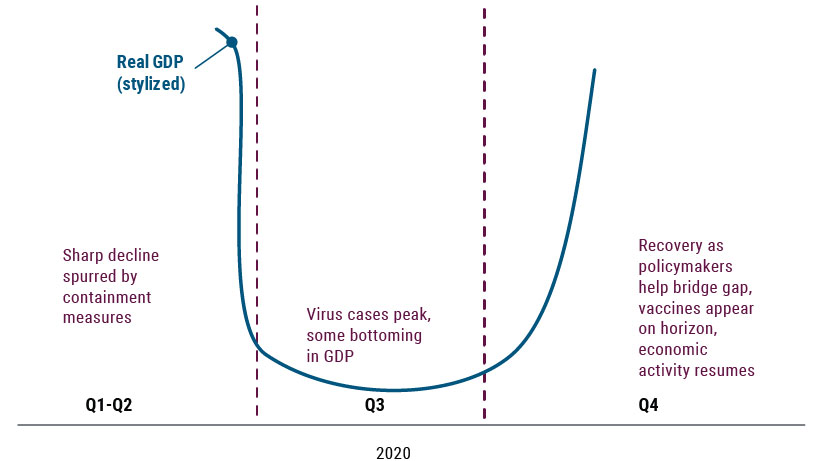

At the moment, we are anticipating a U-shape recovery.

Thanks to the large-scale monetary and fiscal measures rapidly adopted by governments, we believe that global economic activity will be able to bounce back from the current crisis. A gradual recovery should get underway sometime in the next 6 to 12 months. Quickly developing and distributing a vaccine or other effective treatments will be the key to reopening economies around the world.

In the meantime, we believe that the persistence of the virus does not necessarily spell the collapse of the economy and the financial markets. Both have been hit hard, but governments and central banks have committed to doing whatever it takes to take the pressure off the markets.

In our base scenario, the economy sees a U-shape recovery as physical distancing measures are gradually eased across different regions and economic sectors.

The post-COVID-19 world will be different in several ways.

First, societies will question their approaches to globalization and may try to simplify their supply chains in order to be less vulnerable to trade wars and health, environmental and humanitarian catastrophes.

Second, many households will emerge from the crisis with significant debt burdens after losing their jobs or taking big cuts to their income. Once the crisis is over, they will want to rebuild their savings and are likely to prioritize paying down loans and mortgages.

Third, consumers and governments will encourage producing and buying local. Our food sovereignty and our ability to manufacture key medical equipment have been challenged by the crisis and there will be lessons to be learned if we want to avoid the same problems in the future. At the same time, a reversal of globalization trends would lead to lower efficiency and higher costs, fuelling inflation.

A new economic and investment cycle will rise from the ashes of a recession caused by a historic event that caught us all off guard and put an end to the longest expansion in history. But another cycle will follow and reveal new investment opportunities, even if it’s hard to believe that right now.

In the meantime, we need to be patient. Unless your personal situation changes significantly, it's best to stick to your existing investment strategy. Your asset allocation is designed to handle economic tailwinds and headwinds alike. It is during periods like these that we truly learn to understand ourselves as investors. History shows that a properly diversified portfolio may occasionally fluctuate, but is nonetheless designed to help you achieve your goals over the long term.

As portfolio managers, we focus on risk management and capital preservation while seeking out the highest quality issuers. We take advantage of periods of market turbulence to rebalance your portfolio and seize opportunities to acquire holdings that will earn you higher returns over the long term.

To conclude, let’s focus on some of the positive aspects of this experience. The coronavirus has done more for nature than any human being in decades. It has brought families closer together. It has taught us the value of doctors, scientists, farmers, caregivers, cashiers and security staff—the true heroes on the front lines.

We hope that this information helps you better understand the markets. Please don’t hesitate to contact us if you’d like to discuss our investment strategies in more detail. We’d like to reiterate our commitment to keep working hard to help you meet your long-term financial goals by seizing the best opportunities offered on the markets.

Each Desjardins Securities advisor named on the front page of this document, or at the beginning of any subsection hereof, hereby certifies that the recommendations and opinions expressed herein accurately reflect such advisor’s personal views about the company and securities that are the subject of this publication and all other companies and securities mentioned in this publication that are covered by such advisor. Desjardins Securities may have previously published other opinions, including ones contrary to those expressed herein. Such opinions reflect the different points of view, assumptions and analysis methods of the advisors who authored them. Before making an investment decision on the basis of any recommendation made in this document, the recipient should consider whether such recommendation is appropriate, given the recipient’s particular investment needs, objectives and financial circumstances.