Our products and services

Wealth Management

The Vazzoler-Dumont Team offers you comprehensive and evolving financial planningFootnote 1 that is not limited to portfolio management.

Our wealth management client approach

| Planning | Retirement | Insurance | Estate | Investment | Caisse Desjardins solutions | |

|---|---|---|---|---|---|---|

| Retirement Investment | RRSP, RESP businesses and cash | Life | Will | Portfolio management | Mortgage loan | |

| Integrated Financial Estate Tax | RRIF - LIF Annuities | Disability | Mandate | Personal loan RRSP loan | ||

| IPP | Health and critical illness | Trust | VISA card | |||

| Group RRSP | Strategic: Back-to-back annuity, etc. | Travel insurance | ||||

| Pension fund | Property and casualty insurance | |||||

| Business transfer | ||||||

| Team | Firm | External | ||||

The Vazzoler-Dumont Team relies on experts who will take the time to help you with the different financial decisions you will have to make during your lifetime. Whether you are buying a home, financing your children's or grandchildren's education, or selling a business, they are there to advise you.

The Vazzoler-Dumont Team service offer includes retirement planningFootnote 1 for all our clients. Financial planning and estate planning services are also availableFootnote 1.

In addition, so that you can benefit from the most comprehensive services on the market, the Vazzoler-Dumont Team of advisors can assist you when you meet with other professionals, such as lawyers, notaries, tax experts or financial planners.

Portfolio Management

Approach

After analyzing your needs and determining your investor profile, the Vazzoler-Dumont Team of professionals develop a plan for you that includes a comprehensive financial plan and a customized investment policy tailored to your objectives and your obligations.

This policy sets out in writing the guidelines for the allocation of your assets among the different asset classes: cash, fixed-income and stocks.

The portfolio manager in charge is responsible for building an investment portfolio according to your investor profile. This step enables him to make sound and appropriate security choices.

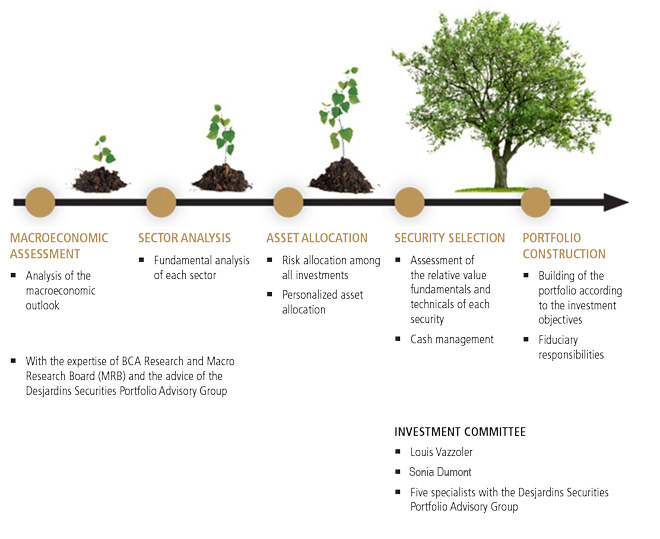

| Macroeconomic Assessement | Sector Analysis | Asset Allocation | Security Selection | Portfolio Construction |

|---|---|---|---|---|

| Analysis of the macroeconomic outlook | Fundamental analysis of each sector | Risk allocation among all investments | Assessment of the relative value fundamentals and technicals of each security | Building of the portfolio according to the investment objectives |

| With the expertise of BCA Research and Macro Research Board (MRB) and the advice of the Desjardins Securities Portfolio Advisory Group | Personalized asset allocation | Cash management | Fiduciary responsibilities | |

| Investment Committee : Louis Vazzoler, Sonia Dumont, Five specialists with the Desjardins Securities Portfolio Advisory Group | ||||

When a security is bought or sold, the portfolio management expert executes the transaction for all of his clients so that they can benefit from the same opportunity, at the same time and at the same price.

Upon acceptance of these terms and conditions, the plan is carefully implemented.

The members of the Vazzoler-Dumont Team are committed to closely monitoring your portfolio and your financial situation by remaining in contact with you and by setting up yearly meetings. Information sheets detailing key trades will be sent to you by email, and quarterly financial letters will keep you abreast of major market trends.

In addition, each year, you will receive a complete tax report that will help you file your income tax return.

Investment Philosophy

The Vazzoler-Dumont Team's approach is characterized by rigour and discipline. Their goal is to generate a returnFootnote 2 comparable to or greater than that of the market, while effectively controlling risk.

Canadian Equities

The core holdings of the portfolio are composed of stocks that are considered to be more stable. In most cases, these companies are leaders in their respective sectors and have solid, stable operations. These issues are normally held for long periods of time. The other portion of the Canadian equity portfolio provides sector diversification. Stocks are chosen based on a thorough analysis of economic conditions. These companies usually have a dominant position in a growing market and are generally traded more frequently to capitalize on market swings.

The stocks in the portfolio must meet certain pre-established criteria in terms of their stock market capitalization, their credit rating, their cyclicity, and their dividend yield and dividend growth, and they must offer optimal diversification.

Foreign Equities

To reduce geographic risk, the portfolio holds some non-Canadian stocks. For diversification purposes, an index approach is used for this part of the portfolio. According to our reading of the global economic environment, certain regions of the world are underweighted or overweighted relative to the MSCI World Index. Currency hedging may be used to reduce foreign exchange risk for holdings in other currencies. Some individual stocks may be added to round out the portfolio.

Fixed-Income Securities

Active management of fixed-income securities that takes into account the duration of the portfolio is employed to exploit divergences between our reading of the economic environment and that of the bond market. For non-registered accounts, dividend income is preferred because it is less heavily taxed than interest income.