Our portfolio management

Our portfolio management service (discretionary)

For your peace of mind!

Main benefits:

- A portfolio built around your needs and profile

- A private portfolio manager backed by a team of experts

- Direct access to your portfolio manager

- An effective and proven investment process

- High-quality service and systematic monitoring of your portfolio

Portfolio management is right for you if:

- You prefer to delegate investment decisions to an experienced specialist

- You want to maximize the risk/return ratio through efficient and rational management

- You're looking for a structured wealth management approach

Fee-based compensation

Our compensation is based on fees set according to a predetermined percentage that depends on the services we provide and the assets under management. It's to your advantage to combine your assets with those of your spouse or other family members to take advantage of even better rates.

Other advantages:

- Transparency regarding the fees you are charged

- No conflict of interest

- Lower management fees than mutual funds

- No per-transaction commissions

- Tax-deductible fees for non-registered accounts

Our investment philosophy

When it comes to investing, we put the security of your capital first. The risk you run is losing money, not being beaten by an index, especially in the short term.

Our investment process

Institutional management and ours: A comparison

While institutional managers use an asset allocation similar to that of an index, regardless of market status forecasts, we feel free to act on our convictions and allow for significant differences between our sector allocation and that of the index.

In other words, we have little interest in a short-term index. We prefer to use intelligent risk management and move away from sectors we consider overvalued or volatile (reactive).

Financial information | Opinions – Trends

Asset classes | Monetary and fiscal policies

Financial products

Macroeconomic analysis

- Market trend

- Economic cycles

Sources: Royal Bank, Russell Investment

Sector analysis

- Overweighting/underweighting

- Geographic positioning

- Tactical allocation

Sources: Credit Suisse, Desjardins Securities

Selection of individual securities

- High-quality securities

- Good credit ratings

- Industry leader

- High dividend yields

Sources: Value Line, Investment Reporter, Morningstar

3-for-1 principle

- Cash flow analysis

- Dividend growth analysis

- Book value analysis

- Profit growth analysis

Source: Value Line

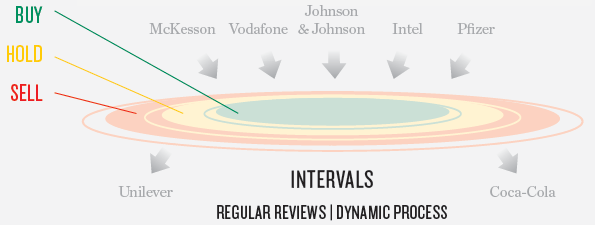

Safety margin

Target price | Floor price

Resultsnote de bas de page 1