Your disbursements and variations in returns

Reality: Variations in returns have a major impact on your retirement capital.

Our observation: Not all retirement projections take this variation into account.

Our program

We use high-performance software to analyze your assets and identify the best gradual disbursement method for you.

Based on a number of assumptions, we select the accounts your liquid assets could come from and propose the best solution for your situation.

If the return is the same, you should opt for portfolio management that shows the smallest variation (in return).

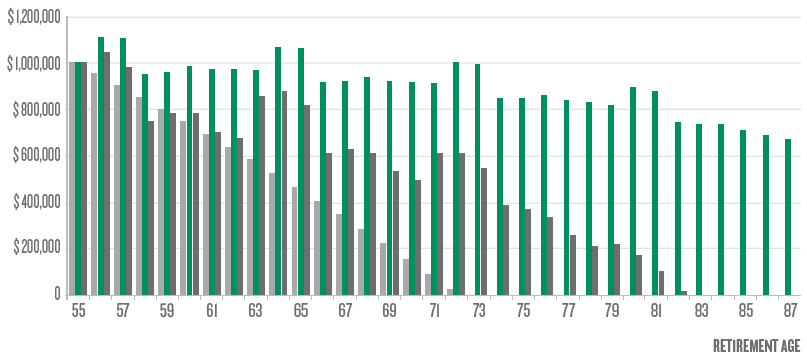

Please see the table below for an idea of how a retiree's capital changes during disbursement, based on the sequence and variation of returns.

Our program provides extra value, and for good reason: you've worked hard to accumulate the amounts invested with us. We want you to be able to enjoy your retirement to the fullest.

Disbursement vs. volatility

Reality: Volatility has a major impact on your retirement capital.

Our observation: Not all retirement projections take volatility into account.

If the return is the same, you should always opt for portfolio management that minimizes volatility. (Please see the table below for an idea of how a retiree's capital changes during disbursement, based on the sequence and volatility of returns.)

Table representing the hypothetical capital of a retiree invested in 3 different portfolios:

Assumptions:

Initial capital: $1,000,000

Annual income: $68,000

Portfolio invested in term deposits with 2% interest rate

Balanced portfolio with 6.8% return

Balanced, lower-volatility portfolio with 6.8% return