Financial letter, Fall 2019, 49th edition

When is the next recession?

In our view, unless China–U.S. discussions hit a structural roadblock or confidence declines sharply, a recession in North America is unlikely in the next 12 to 18 months. Note that there is no historical precedent for a recession amid such flexible monetary policy and monetary conditions. Due to the sheer size of domestic demand, the U.S. economy is partially insulated from foreign economic conditions. Will this time be different? Let’s say I have my doubts.

Why? For a number of reasons, including flexible monetary conditions, a proactive Fed, full employment, wage growth, available savings and business productivity. With low global exposure, the U.S. economy will again be fuelled by domestic demand, which accounts for 68% of GDP.

Although unlikely in North America, recession has taken root in Italy and could also hit Germany (impacted by a sharper downturn in international trade), the U.K. (with the Brexit effect) and Japan (owing to the consumption tax hike).

| Index | Level | 3 months | 6 months | 1 year |

|---|---|---|---|---|

| S&P/TSX | 16 658.63 | 2.48% | 5.13% | 7.03% |

| S&P 500 (US$) | 2 976.74 | 1.70% | 6.08% | 4.25% |

| MSCI Emerging Markets (US$) | 1001.00 | -4.16% | - 3.46% | -1.69% |

| MSCI World (US$) | 2 180.02 | 0.66% | 4.87% | 2.44% |

| C$/US$ exchange rate | 0.76 | 0.76 | 0.75 | -2.49% |

| Canada 2-year bond yield | 1.58% | 1.47% | 1.55% | -28.64% |

| Canada 10-year bond yield | 1.36% | 1.47% | 1.62% | -43.92% |

| Oil (US$) | 54.07$ | 58.47$ | 60.14$ | -26.18% |

| Gold (US$) | 1 472.38$ | 1 409.45$ | 1 292.30$ | 23.47% |

And the political landscape? An anti-conformist, unpredictable and impulsive President Trump is a major risk vector for the global economy and international trade. Since his election in 2016, he has sent some 14,000 tweets (about 10 per day on average) to his 64 million followers.

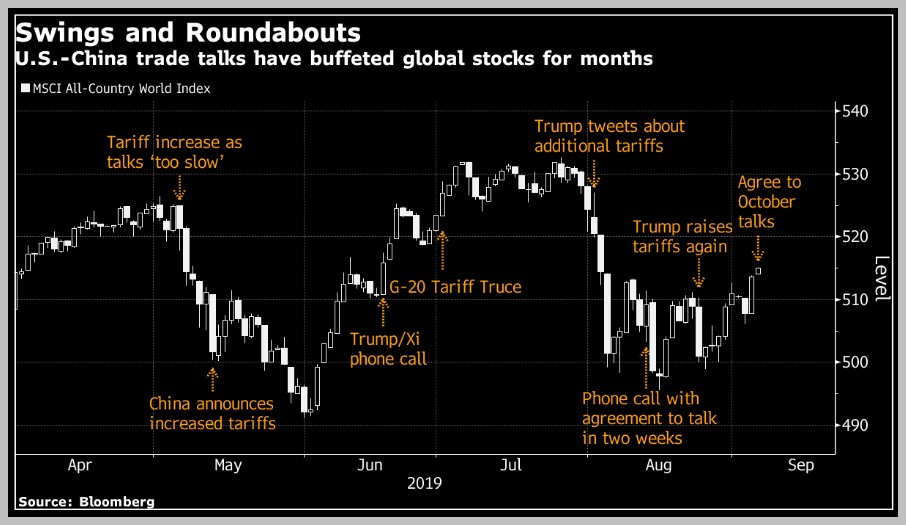

Historically, investors have tended to exclude politics from their analytical models. In the Trump era, this variable is a must. According to Bank of America Merrill Lynch and J.P. Morgan, days when his twitter feed exceeds his daily average of 10 tweets have an adverse impact on stock markets. That being said, note that the Dow Jones has been up 42% since Trump’s election. The following chart depicts the impact of Trump, tweets and trade (TTT) on the MSCI All Country World Index.

As Trump is seeking a second term, we assume that by November 2020, he will engage in behaviour conducive to his re-election. Having repeated that the S&P 500 was the barometer of his success, he will avoid causing long-lasting erratic movements. Will he manage to stay the course and rein in his reactionary impulses from now until November 2020? Particularly with the Democrats striving to impeach him.

Interest Rates

The decline in interest rates remains the big surprise of 2019. Since fall 2018, it has been accentuated by economic, monetary and financial differences between countries, as well as by U.S. foreign policy. By maintaining robust monetary stimulus, the Bank of Japan and the European Central Bank pushed their interest rates into negative territory, triggering a global movement. There is approximately $17 billion worth of negative bond yields worldwide (equal to 25% of the global bond market). In Germany, 10-year federal bonds hit a record low of -0.71% in August. Driven by international capital flows, North American bonds have also seen unprecedented low yields. U.S. 30-year treasury bonds crossed the 2% threshold in August. In Canada, economic resilience, falling mortgage rates and high consumer debt levels support the central bank’s status quo, but the Bank of Canada will keep a close eye on developments surrounding trade tensions. Myriad uncertainties are expected to maintain a very low rate environment.

The fixed-income strategy will depend on economic and financial cycle conditions, but also on U.S. politics. U.S. elections set against a backdrop of impeachment are blurring the longer-term outlook. When the leading indicators blink red, signalling the end of the cycle, we will act to fully capitalize on low rates. An overweight position in medium- and long-term bonds, a longer duration than the benchmark, and underweighting in corporate securities may then be appropriate. In the meantime, our strategy is to underweight bonds and set a shorter portfolio duration than the benchmark.

N.B. We recently changed our benchmark for the fixed-income component. The previous benchmark, the FTSE Canada Universe Bond Index, has an average duration of 8.25 years, which is far too long for our investors. For instance, 30-year bonds make up 30% of this index. This type of term will never be included in our portfolios given the average age of clients and the current low-rate environment. Our new mixed benchmark index is as follows:

50%, the FTSE Canada Short Term Bond Index, 2.7-year duration; and 50%, the FTSE Canada Mid Term Bond Index, 6.3-year duration

These two indexes have an average duration of 4.5 years, which is much more realistic and less restrictive.

Portfolio Strategies

Overall, our investment decision tree will be influenced by key political issues, international trade, public policy (including monetary, budgetary and fiscal governance), economic data (including the PMI, leading indicators, yield curve, corporate profits, labour unit costs and inflation), financial markets and the general mindset of investors. Active management is all about optimizing the total return of a portfolio.

At present, the economic and financial backdrop is favourable to equities, underweighting bonds and overweighting cash compared with the target to take advantage of market volatility and identify opportunities when they arise. Strategically, it is still too early to adopt a defensive position in view of an end in the cycle. The current turmoil in the world economy is more like a typical manufacturing cycle than a recession. In addition, given the high degree of monetary easing in industrialized countries, a global recession remains unlikely in 2019 or 2020.

Geographic Allocation

United States (overweighting)

Our baseline scenario is that Trump is calibrating his strategy to win a second term. The initiation of an impeachment process in the U.S. House of Representatives will make for some highly captivating political manoeuvring. U.S. monetary policy, which is still flexible, will warrant another key rate cut in 2019, followed by the status quo for 2020. The current economic cycle will continue to be boosted by monetary policy flexibility, domestic demand driven by full employment, wage growth, stabilization in the manufacturing industry and consumer confidence. We continue to focus on the U.S. market, with its affordable financial and healthcare sectors, as well as its growth powerhouses (communications services and technology).

Canada (underweighting)

Sceptics will continue to be confounded by the vitality of the economy and domestic demand. Canadian monetary policy will remain flexible against a backdrop of the status quo until the Bank of Canada can properly assess the combined effect on the economy of full employment, low interest rates, inflation and consumer spending, as well as the international situation. The loonie (target: 75¢ to 77¢ in the short term) is a key variable in this recommendation.

Euro zone (underweighting)

The manufacturing cycle has hit its short-term trough and entered its recovery phase. The de-escalation of trade tensions, stabilization of economic growth in China, recovery in the automotive industry and stimulating fiscal policy will bring a breath of fresh air to Germany and the rest of the euro zone. As in Italy, a technical recession is nonetheless conceivable in Germany. European monetary policy remains expansionary. Trailing North America in its cycle, the euro zone shows signs of improvement in 2020.

United Kingdom: Brexit? Hard Brexit? Soft Brexit? Brexin? Who knows? British politics is unpredictable and perhaps the ultimate combat sport on the planet. Boris Johnson has run the political clock to the extreme, to the point that his own brother chose nation over family, resigning in September. A general election is conceivable and could determine the outcome of this highly contentious saga.

Signs of trade reconciliation and improvements in the manufacturing industry could result in increased weighting in European securities and emerging markets. Our preference will be to make such investments with a slight delay rather than enter too early and be disappointed. Therefore, we are waiting for concrete signs before we take action.

Sector Allocation

We have been keen on technology and communications services for a long time. Apart from the recent underperformance, we believe that the structural factors supporting this sector remain in place. To balance portfolio risk, we rely on the defensive features and attractive valuations (unlike other defensive securities) of the healthcare sector. In addition, the industrial sector has been producing decent returns over the past few years, but trade tensions have pushed back some orders and are likely to hamper this sector.

Conclusion

Our overall interpretation of end-of-cycle indicators (yield curve, leading indicators, rate spreads, PMI, confidence, investment, debt levels and corporate inventories) is still positive. Aside from a flashing yellow light for the yield curve, manufacturing PMI and corporate debt levels, other indicators point to the cycle extending.

Accordingly, bouts of anxiety and volatility will have to be ignored by focusing on the economic backdrop and leading indicators to fully capitalize on the investment cycle.

If history repeats itself (typical manufacturing cycle: 18 months of contraction followed by 18 months of recovery), the global economy will stabilize in the coming months and then embark on a recovery. Never in history has a recession materialized when monetary policy was so expansionary worldwide, just as a down market has never happened without a recession.

We believe that, by actively managing your investments, we help maximize your long-term return. We hope this information will help give you a better understanding of the markets. Feel free to contact us for a more in-depth discussion of our investment strategies. We are committed to working ever harder to find solid opportunities in the financial markets, so as to help you reach your long-term goals.

Each Desjardins Securities advisor named on the front page of this document, or at the beginning of any subsection hereof, hereby certifies that the recommendations and opinions expressed herein accurately reflect such advisor’s personal views about the company and securities that are the subject of this publication and all other companies and securities mentioned in this publication that are covered by such advisor. Desjardins Securities may have previously published other opinions, including ones contrary to those expressed herein. Such opinions reflect the different points of view, assumptions and analysis methods of the advisors who authored them. Before making an investment decision on the basis of any recommendation made in this document, the recipient should consider whether such recommendation is appropriate, given the recipient’s particular investment needs, objectives and financial circumstances.