2019 Fourth quarter update

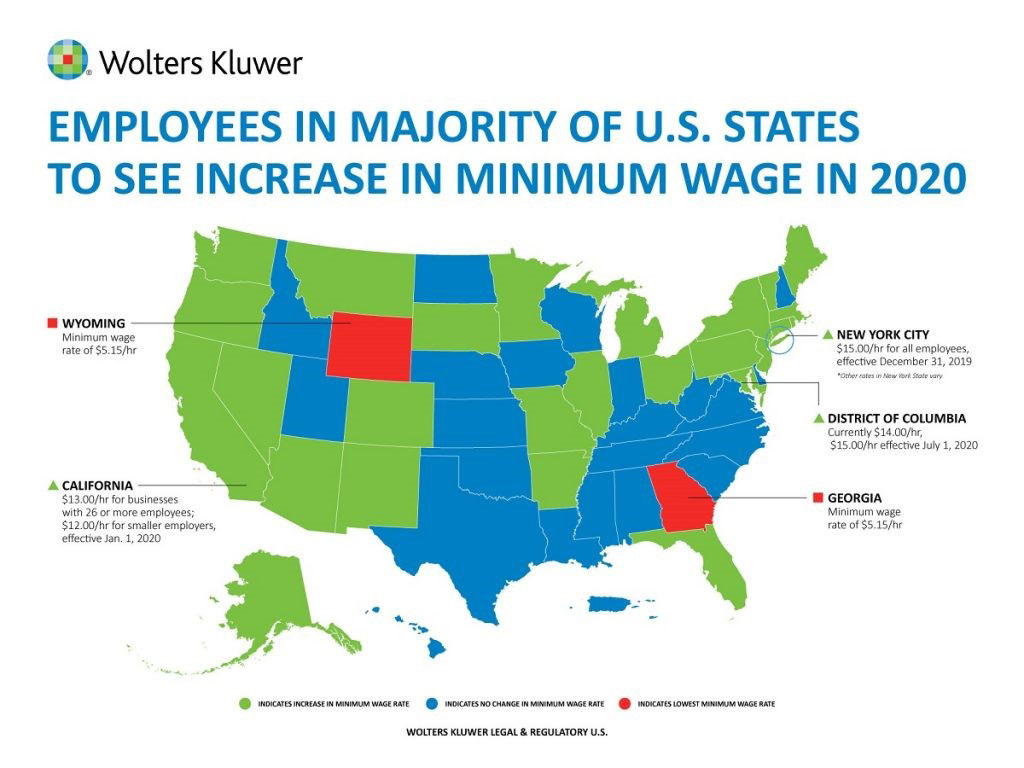

It's hard to believe that 20 years ago we were celebrating the new millennium, and now we're into the third decade of the 2000s! At a time when the stock market is reaching record highs, one question seems to keep coming back. When will this unprecedented expansion come to an end? One thing's for sure: North American consumers aren't slowing down amid the lowest unemployment rates in 50 years. To celebrate the new decade, we'll go over some of the economic highlights of the 2010s before looking forward into 2020 and detailing our strategy. But before we dive in, we want to highlight upcoming increases to minimum wage in the US (see below). The states maintaining the status quo are in blue and those increasing minimum wage are in green. It will be sure to give another boost to consumer spending. But at $5.15 an hour, Wyoming and Georgia are tied for lowest minimum wage.

While we've been in an expansion for some time now, there isn't an expiration date on bull markets. History has taught us that there's never been a recession under accommodative monetary conditions, and there's never been a major correction (more than 20% drop in the stock market) without a recession. In theory, recessions are caused by a drop in demand related to a potential loss in household and business confidence. It's up to the central banks to prevent recessions. On our end, we need to adopt an appropriate strategy and manage risk.

1 – 2010–2019: A decade for the history books

Over the last 10 years, the S&P 500, the US market's flagship index, increased 249%—approximately 1.2 times its historical average. And as you can see below, Canadian markets didn't do too poorly either. While there were a few bad years in the mix, the 2010s were generally kind to Canadian shareholders.

Over the last decade in the US stock market, we didn't see a drop of more than 20% from any given peak (in financial terms, this would be called a bear market). But it's not like there wasn't any uncertainty. Between the May 2010 flash crash, the European sovereign debt crisis of 2011 and 2012, the devaluation of the Chinese yuan in 2015, Brexit, current trade tensions and six 10% corrections since 2010, nothing has stopped the longest bull market to date.

And what's behind this unusual phenomenon? The central banks. How many times have they stepped in when things were a bit touch and go? And the latest is the Fed's U-turn on its monetary policy. The long-awaited 2018 rate increase made room for 3 successive decreases in 2019 after December 2018, which was the worst month since the Great Depression.

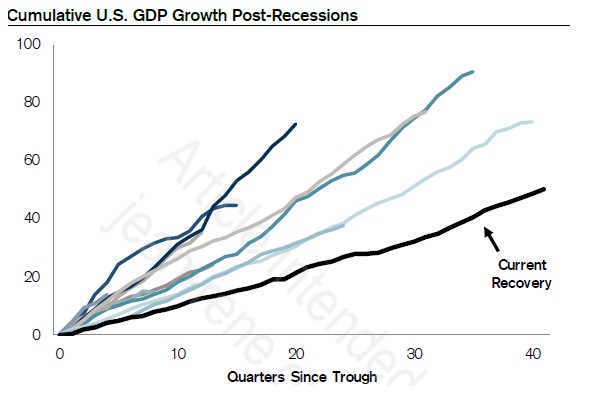

And investors tend to have a hard time forgetting worrisome events, seeking out reassurance to calm their anxieties. This is why we've had such a hard time appreciating the bull market with peace of mind. Our reservations kept us from experiencing market euphoria, which often signals the end of expansions. While perceived risk remained high, the cycle's economic growth had a solid foundation, although it was more modest than in the past. Not only is this the longest recovery on record, but it's the slowest too. Just one more thing that makes the 2010s stand out.

2 – 2020 outlook: What can we expect now?

It's hard to tackle this question without going over our more modest expectations. After a remarkable year, we expect returns to drop back down to the normal range in coming months. However, we do believe that there's a relatively low risk of recession in 2020. Central banks will remain accommodative, keeping their rates low. Barring any drastic change in policy, the US President and his administration will try to reach a trade deal with China coming up to the 2020 election. While consumer confidence is high, the private sector's isn't doing as well. Amid anxieties surrounding US-China relations, many companies have suspended projects and investments, both critical drivers of the current expansion. In other words, a resolution of trade tensions would shore up confidence and enthusiasm.

Plus, other positive factors indicate that the current cycle will continue.

According to BCA Research, there are 3 reasons to feel optimistic about the economy.

- Financial conditions are loose (low interest rates).

- Manufacturing is showing signs of stabilization, as evidenced by the reduction in inventories.

- Trade tensions have recently cooled off and, though it might not be perfect, a deal between the US and China is on the horizon. But considering that President Trump is unpredictable, it's best to wait for the ink to dry. And even then, we can't forget his behaviour with Mexico and Canada after announcing the USMCA trade deal.

There’s also the job market operating at full capacity, low inflation and a positive consumer mood. We believe that consumer spending will continue to support current trends.

But according to our research, there are issues we can't ignore in 2020:

- US election

- Monetary policy (interest rates)

- Trade tensions (protectionism)

- Geopolitical conflict

In a year filled with so many big events, there may be volatility and higher anxiety than in previous months. In 2019, the S&P only had 37 daily fluctuations over 1%, compared with an average of 54 since 2010 (64 in 2018). Also, the S&P only had 7 daily fluctuations over 2%, compared with an average of 12 since 2010 (20 in 2018). Yes, it was a growth year, but more modest than 2019.

3 – 2020 position

A new administration in the White House could have reverberations in North American stock markets, leading us to review our portfolio positioning and exposure to certain sectors. This possible outcome isn't factoring into our decision making yet, but we'll be paying close attention coming up to November 2020.

We're keeping our current stock position (growth) close to our targets for all portfolios. We think it's appropriate to keep stocks as our preferred asset class without increasing our exposure. Over the course of the last quarter in 2019, we increased our cash reserves by taking profits. This cash reserve will come in handy during more volatile periods. It's a top asset class, essential in active portfolio management. Because we believe that the current year will have its fair share of rebounds, we're comfortable with active liquidity management.

When it comes to geography, the US market remains attractive. We will likely increase our exposure to overseas markets by increasing our European assets and those in emerging markets if the opportunity arises. We're remaining neutral when it comes to Canadian equity, meaning that we won't favour it over other stock markets. Our target was between 40% and 50% of the growth component.

Considering that this bull market has been persisting for over 10 years, we believe that the best way to reach our long-term growth objective is through risk management. This begins by acknowledging that returns are beginning to be normalized (closer to the historical average) and avoiding taking unjustified risks to beat the average. To make this work, we're focusing on diversifying styles, asset classes (stocks, fixed income, cash and alternatives) by bringing in some external managers for specific tasks.

Did you know?

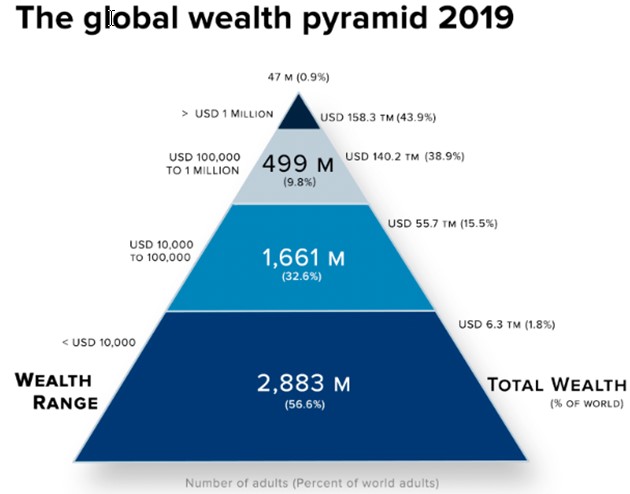

A sign that the last few months were exceptional? The number of people worth over $1 million increased by 0.9% in 2019. This means that nearly 1% (47 million) of the global adult population holds 43.9% of the world's total wealth (see the infographic about growing wealth inequality below). If nothing else, this puts things into perspective.

Each Desjardins Securities advisor named on the front page of this document, or at the beginning of any subsection hereof, hereby certifies that the recommendations and opinions expressed herein accurately reflect such advisor’s personal views about the company and securities that are the subject of this publication and all other companies and securities mentioned in this publication that are covered by such advisor. Desjardins Securities may have previously published other opinions, including ones contrary to those expressed herein. Such opinions reflect the different points of view, assumptions and analysis methods of the advisors who authored them. Before making an investment decision on the basis of any recommendation made in this document, the recipient should consider whether such recommendation is appropriate, given the recipient’s particular investment needs, objectives and financial circumstances.