Financial Letter - June 2023

MAY SEES DOUBTS CREEP IN

STOCK MARKET

After a strong start to the second quarter in April, markets turned more hesitant in May. Investors found themselves revising their expectations about the Federal Reserve's strategy and facing new concerns from the banking sector, all while US politicians dragged out negotiations over raising the debt ceiling.

In May, the leading US index, the S&P 500, picked up 0.4%, but its equal-weight counterpart lost 3.8%. The top five companies (NVDA, GOOGL, AMZN, MSFT and AAPL) added 2.4%, with the rest detracting 2.0%. Since the start of the year, the index has gained 9.6%—but the equal-weight version is down 0.7%! Another sign of concentrated performance: the 10 largest S&P 500 constituents are responsible for more than 104% of the index's overall performance. And less than 30% of its constituents have outperformed the index, a figure that should, in theory, be closer to 50%. After a difficult 2022, the Nasdaq is now up 24.1% this year, restoring its credibility and far outpacing the S&P 500, Dow Jones (0.25%) and Russell 2000 (-0.1%), with somewhat exaggerated excitement over artificial intelligence to thank.

As for the TSX, it lost 4.95% in May, bringing its year-to-date gain to just 2.28%. During the month, technology was the only sector to end up in positive territory, with energy (-8.0%), telecommunication services (-8.2%) and materials (-10.5%) leading the losses.

ECONOMY

Despite a slight uptick in the unemployment rate, the US economy added 339,000 new jobs in May. The GDP growth forecast for 2023 has been raised to 1.1%, up from 0.3% in December. Recent economic data has generally been above expectations, and consumer confidence is returning as inflation falls. After peaking at 9.1% in June 2022, the Consumer Price Index came in at 4.9% in April and should near 3.5% over the next two months as base effects normalize.

BONDS

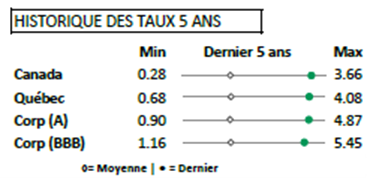

The resilience of both the Canadian and US economies has shown up in bond markets. Until just recently, investors had been pricing in rate cuts beginning this summer—a forecast that has now been revised. Two-, five- and 10-year yields jumped a respective 56, 47 and 35 basis points in Canada, and 39, 27 and 22 basis points in the United States. These adjustments caused the Canadian bond index to slip 1.69%.

At current levels, Canadian yields are near their five-year highs, making them an increasingly attractive option for investing fresh capital. We took advantage of the situation to lengthen duration in our discretionary management portfolios.

COMMODITIES

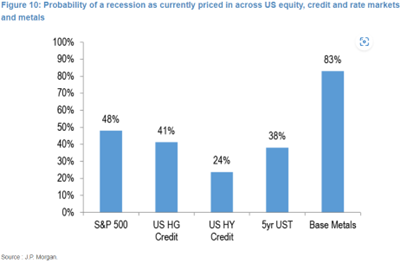

Disappointing Chinese economic data has put pressure on the base metals complex. While the debate rages as to whether or not a recession is on the horizon, some asset classes are trading at valuations that suggest different degrees of likelihood.

According to JP Morgan, current base metals prices suggest an 85% chance of an impending recession, higher than any other asset class. That should be of interest to contrarian investors!

Between hesitancy on the major non-US stock markets and rate cut expectations being pushed back, we've seen retreats in most asset classes, with the exception of cash, resulting in minor setbacks for all profiles in May. But despite recent dips, returns remain in positive territory across the board.

Thank you for placing your trust in us.

Please feel free to reach out with any questions or concerns.

Each Desjardins Securities advisor named on the front page of this document, or at the beginning of any subsection hereof, hereby certifies that the recommendations and opinions expressed herein accurately reflect such advisor’s personal views about the company and securities that are the subject of this publication and all other companies and securities mentioned in this publication that are covered by such advisor. Desjardins Securities may have previously published other opinions, including ones contrary to those expressed herein. Such opinions reflect the different points of view, assumptions and analysis methods of the advisors who authored them. Before making an investment decision on the basis of any recommendation made in this document, the recipient should consider whether such recommendation is appropriate, given the recipient’s particular investment needs, objectives and financial circumstances.