Financial letter, Spring 2019, 47th edition

Panicking rarely pays off!

Several factors took a heavy toll on global stock markets in the fourth quarter of 2018. Recent statistics, indicative of a slowing global economy, emphasized the uncertainty surrounding the economic outlook and undermined investor confidence. With tighter monetary conditions and increased pessimism about expected returns, share values have plummeted.

Last year will go down in history in the United States as one of the worst since 1976 on this front. The fourth quarter and the month of December were the worst in terms of performance since 1946.

As if by magic, the uncertainty hovering over the financial markets lifted at the dawn of the new year. What changed at the last stroke of midnight? The tone of the major central banks became more nuanced, even accommodating. After raising the key rate to 2.25% in December, Jerome Powell, Chair of the Federal Reserve in the United States (the Fed), signalled the Fed’s patience at the American Economic Association meeting on January 4.

“With the muted inflation readings that we’ve seen coming in,” he said, “we will be patient as we watch to see how the economy evolves. But what I do know is that we will be prepared to adjust policy quickly and flexibly, and to use all of our tools to support the economy, should that be appropriate to keep the expansion on track.”

The end result: stock markets took off in the first quarter of 2019.

| Indexes | Level | 3 months | 6 months | 1 year |

| S&P/TSX | 16 102.09 | 13.27 % | 1.81 % | 8.09 % |

| S&P 500 (US$) | 2 834.40 | 13.65 % | -1.73 % | 9.48 % |

| MSCI Emerging Markets (US$) | 1 058.13 | 9.90 % | 1.79 % | -7.11 % |

| MSCI World (US$) | 2 107.74 | 12.65 % | -2.34 % | 4.61 % |

| C$/US$ exchange rate | 0.75 | 0.73 | -0.77 % | -3.49 % |

| Canada 2-year bond yield | 1.55 % | 1.64 % | 1.59 % | 51.82 % |

| Canada 10-year bond yield | 1.62 % | 1.97 % | 2.43 % | -22.67 % |

| Oil (US$) | 60.14 | 45.41 | 73.25 | -7.39 % |

| Gold (US$) | 1 292.30 | 1 282.45 | 1 192.50 | -2.51 % |

What’s in store for 2019?

According to the OECD, global economic growth will continue to slow against the backdrop of high public policy uncertainty, ongoing trade tensions and the deterioration of business and consumer confidence. In early March, the OECD revised almost all of its forecasts for the G20 economies downward to predict real GDP growth worldwide of 3.3% in 2019, followed by 3.4% in 2020.

It is true that global expansion is running out of steam and will grow more slowly in 2019, but this does not inevitably point to a recession. Just because a cycle is getting on in years or has exceeded its historical average doesn’t mean that it is necessarily coming to an end. Neither age nor duration indicate a pending recession. Recessions have two things in common: excess (real estate, financial, leveraging, debt, investment, risk-taking and inflation) and monetary policy. Aside from a flashing yellow when it comes to credit spreads and business debt, other indicators point to the cycle extending to 2020. As of July, the current economic cycle will have been the longest in the United States since 1850, toppling that of 1991–2001 (120 months). The current economic environment (full employment, wages, savings, taxation, domestic demand) and financial backdrop (flexible monetary conditions) in the United States ensures that it will continue and pull the rest of the world along with it.

Interest rates

With respect to fixed income securities, the monetary pause and patience of the major central banks signal a period of low interest rates, at least until the economy can grow and inflation rise in a sustainable manner.

The Bank of Canada (BoC) softened its stance in March. Recognizing that the economic slowdown was more pronounced and widespread in Q4, the BoC revised its forecasts down for Q1 in 2019. Given the heightened uncertainty about the timing of future rate increases, the Governing Council will closely monitor changes in household spending, the oil markets and global trade policies. In essence, the BoC has hit the pause button!

The fact remains, the rate hikes in 2018 took a larger bite out of household budgets than anticipated. According to Statistics Canada, household debt, expressed as a proportion of disposable income, hit a new high at 178.5% in Q4. For each dollar of assets, Canadians hold $1.79 of debt. With the same alarm bells ringing at the Fed, which hit the pause button, the key rate will remain unchanged until the second half of 2020. The Fed may even prefer maintaining the status quo until the end of the cycle. The market, in all its wisdom, is already counting on rates dropping as early as December 2019.

Portfolio strategies

Discretionary management can be highly profitable for clients when we take advantage of periods of volatility by moving quickly to profit from opportunities on behalf of all of our clients.

Cash is an attractive alternative: its greatest value does not necessarily stem from the kinds of returns it can buy, but rather from the possibility of profiting from market changes that it offers, such as what happened in Q4 of 2018. Last September, we took profits on shares to increase liquidity and to use this cash on the U.S. market in January after it saw a 19% drop between its peak and its trough in 2018.

Over a 6- to 12-month horizon, the investment strategy is positive, but marked by relative caution. Our preferences are the United States, the technology sector and financial and health securities, leaning slightly in favour of a growth style.

Another recent strategy was the introduction of a real-asset alternative fund in the portfolio. It will help to enhance the portfolio’s risk-adjusted return. In Q1 2019, we added this asset class, which has the advantage of not correlating with the stock and bond markets. In the past, this asset class was reserved exclusively for retirement funds. The Romspen Mortgage Fund has been added to the portfolio. Historical returns have reached 7 to 10% over the last 25 years, with no negative years. Our objective for the coming year is to allocate 8 to 10% of the portfolio to this asset class by adding another alternative fund to complement the Rompsen fund.

Without a doubt, the cycle will end, but it is still early in the game to take a position and adopt a strategy that is too defensive! Naturally cautious, we currently recommend balance in the face of the current outlook.

Geographic allocation

With the outlook varying from one country to the next, the importance of geographical allocation makes even more sense.

United States (overweighted)

In the United States, GDP should grow 2.5% in 2019, then 2.2% in 2020. Aside from the more moderate effect of the budgetary policy, the economy is supported by a labour market that has reached full employment and by flexible monetary conditions. The partial closing of the federal public service will have an impact on Q1 results, but nothing that could compromise the rest of the year. The low borrowing rates and rise in wages will boost consumption. With consumption (68% of GDP, of which 69% is in services) comes an extended economic and investment cycle! Together with consumption, business investment will stimulate domestic demand.

Less dependent on international trade than Europe and the emerging countries, the United States will remain the world’s engine in 2019 and, in all likelihood, until the end of the cycle. As November 2020 approaches, it is conceivable that the budgetary and fiscal policy will support the economy. Neither the president nor the Republicans or Democrats are politically interested in seeing the economic cycle get bogged down.

Canada (underweighted)

Economic growth in Canada is expected to reach 1.4% in 2019 and 1.7% in 2020. The slowdown in economic activity and, in particular, the weakening of domestic demand in 2018 caused the outlook for growth to be revised downward. This didn’t prevent the TSX from achieving an outstanding 13.27% return in Q1 of 2019.

Except for the surprisingly dynamic labour market (+122,700 new jobs created in January and February, of which 98,300 were full time), several indicators (including consumer spending, the housing market and business investment) are losing steam. In keeping with a stronger and more widespread slowdown, the BoC hit the pause button on March 6.

In Canada, the monetary policy should provide enough oxygen to households to help them adjust to the rising impact of borrowing rates in 2018 and stimulate domestic demand. Households will also benefit from the positive impact of full employment on wages. Stable oil prices, greater transportation capacity in the West and federal government budget expenditures will underpin investment.

Europe (underweighted)

The growth of real GDP in the euro zone slowed considerably throughout 2018 and should remain a modest 1% in 2019 and 1.2% in 2020. Industrial output was especially low. The easing in external demand and one-time factors contributed to the slowdown last year, but slower growth in trade within the zone, significant political uncertainty and flagging confidence also suggest slowing demand, which could last for some time to come.

In the United Kingdom, growth should remain weak and fall below 1% in 2019 and in 2020. The uncertainty that continues to surround Brexit and the current slowdown in economic expansion in the euro zone are weighing heavily on business confidence, investment and export outlook.

A technical recession is conceivable against the backdrop of uncertainty relating to public policy and ongoing trade tensions.

Conclusion

After stumbling in Q4 of 2018, and posting one of the worst returns in a decade, the markets have rebounded, recording one of the best performances in 10 years! All of the losses have been reversed, a reminder to investors that panicking rarely pays off.

A Brexit agreement or postponement, any kind of trade agreement between China and the United States and the expected improvement in global trade could boost investor optimism and drive markets higher.

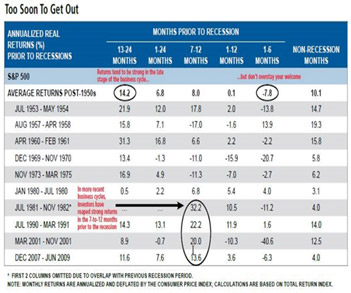

A recession will certainly happen, yet it is difficult to believe it will in the very short term. As shown in the table below, the 7- to 12-month period preceding a recession records substantial gains. During the four most recent recessions (1981, 1990, 2001 and 2007), the S&P 500 rose 21.9% on average (13.6% minimum, 32.2% maximum).

Volatility is a fact of life that investors must come to terms with and get used to. One of the most crucial parts of our job is to ensure that every investor has a portfolio that reflects their age, investment horizon and risk tolerance. For example, the older the investor, the fewer stocks they will hold in their portfolio, since their investment horizon is not as long for reversing any losses incurred during a downturn.

We believe that, by actively managing your investments, we will help you maximize the long-term return. We hope this information will help give you a better understanding of the markets. Feel free to contact us for a more in-depth discussion of our investment strategies. We are committed to working ever harder to find solid opportunities in the financial markets, so as to help you reach your long-term goals.

Each Desjardins Securities advisor named on the front page of this document, or at the beginning of any subsection hereof, hereby certifies that the recommendations and opinions expressed herein accurately reflect such advisor’s personal views about the company and securities that are the subject of this publication and all other companies and securities mentioned in this publication that are covered by such advisor. Desjardins Securities may have previously published other opinions, including ones contrary to those expressed herein. Such opinions reflect the different points of view, assumptions and analysis methods of the advisors who authored them. Before making an investment decision on the basis of any recommendation made in this document, the recipient should consider whether such recommendation is appropriate, given the recipient’s particular investment needs, objectives and financial circumstances.