Our Services

Wealth Management

Team Roy, Émond and Leduc provides comprehensive and evolving financial planningFootnote 1 that is not limited to portfolio management.

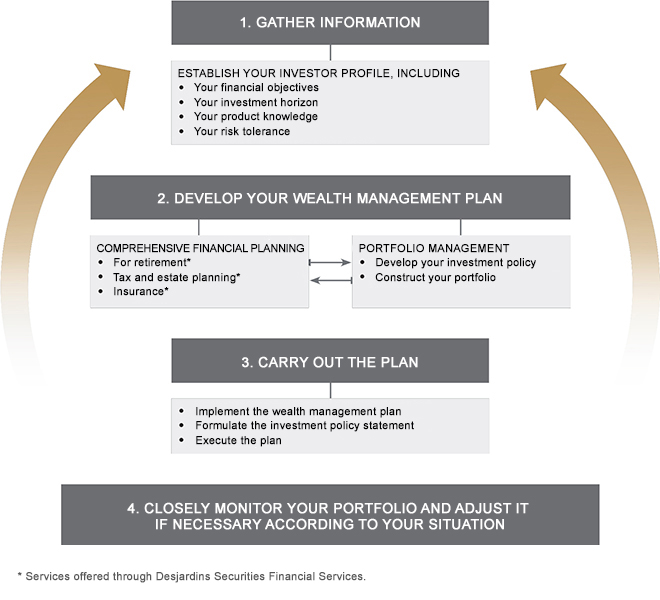

In carrying out a wealth management mandate, we take the following steps:

- First, we meet with you to obtain the necessary information to establish your investor profile. We make it a point to clearly understand your financial goals, your investment horizon, your level of knowledge of investment products, and your risk tolerance.

- Then, in step 2, we put in place your wealth management plan, which may include an integrated financial plan, i.e. one that takes into account tax, estate and retirement considerations as well as your insurance needs. In addition, we develop an investment policy and determine the structure of your portfolio.

- In step 3, we implement your wealth management plan.

- We then closely monitor your portfolio and, if necessary and according to changes that may have occurred in your situation, we update it.

Our team relies on experts who will take the time to help you with the different financial decisions you will have to make during your lifetime. Whether you are buying a home, financing your children's or grandchildren's education or selling a business, we're here to advise you.

Our service offer includes retirement, financial and estate planningFootnote 1.

In addition, so that you can benefit from the most comprehensive services on the market, our advisors can assist you when you meet with other professionals, such as lawyers, notaries, tax experts or financial planners.

Portfolio management

We’re here to help you meet your goals and financial obligations

Your portfolio manager will build an investment portfolio based on your investor profile.

Here’s our step-by-step process:

- Analyze your needs

- Determine your investor profile

- Design your financial plan

- Detailed financial planning

- Personalized investment policy

Our investment philosophy can be summarized in 2 words: diligence and discipline

Our goal is to generate returnsFootnote 2 that meet or exceed the market’s performance while effectively controlling risk. Our portfolios are made up of 3 main categories of securities:

North American equities

- Securities considered stable to hold over the long term

- Companies identified as leaders in their fields

- Companies known for having robust and stable operations

- Securities specially selected to increase sector diversification following an in-depth analysis of current economic conditions

- Leading securities within a growing market

- Frequently traded securities to take advantage of market moves

Foreign equities

- Stocks in foreign companies to decrease geographic risk

- May be underweight or overweight in certain global markets relative to the MSCI World Index

Fixed-income securities

- Actively managed investments with consideration for portfolio duration

- Capitalize on differences between the economic outlook and the bond market