What sets us apart

One client at a time

While the industry seems increasingly focused on standardization, we favour a comprehensive and personalized approach to each and every client.

Always present

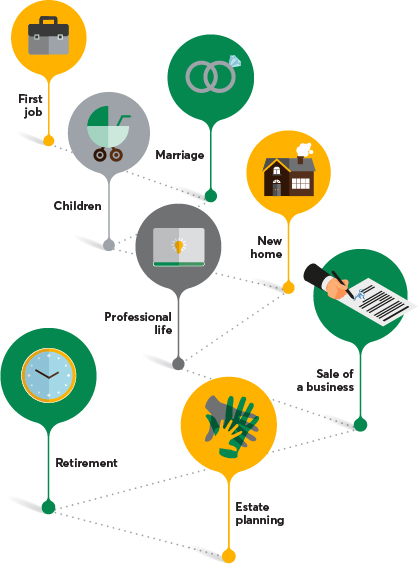

Like the markets, your life is constantly changing. Whether you’re getting married, expecting a newborn, buying a new property, selling a business or retiring, we’ll make sure your portfolio is adjusted to reflect your evolving needs and aspirations.

- First job

- Marriage

- Children

- New home

- Professional life

- Sale of a business

- Retirement

- Estate planning

Financial coaching

We believe it’s important to promote financial literacy and to help you understand your investments better over time. We are confident that this knowledge will enable you to navigate the world of finance with greater comfort and peace of mind.

Income investing

Our management style is aimed at providing you with stable and high investment income that shields you against market fluctuations. Our objective is to offer you competitive returns based on your investor profile and the economic environment.

Environmental, social and governance (ESG) criteria

We believe that the investments in our clients’ portfolios should not only deliver strong returns but also have a positive impact on society, today and in the future. Before we invest, we ask ourselves questions like:

- What are the environmental practices of the company or fund manager?

- Does the company have a solid governance structure?

- What are the values of the company or fund manager? Do they have progressive social policies?

A team of specialists

We work with a team of in-house experts who are equipped to help you with a wide range of financial needs:

- Complex financial planning specialist

- Estate analysis specialist

- Tax specialist

- Business transfer specialist

- Trust specialist

- Insurance specialist

Our values

Integrity, ethics, rigour, availability, transparency, efficiency and discipline.

To respond to your needs and help you achieve your goals, we incorporate efficiency, flexibility and rigour in each stage of our wealth management process. Our commitment to integrity and ethics permeates everything we do, from building relationships with our clients to selecting investment products. Transparency and availability are an integral part of our management model, reflecting our commitment to open and honest communication.

Our approach

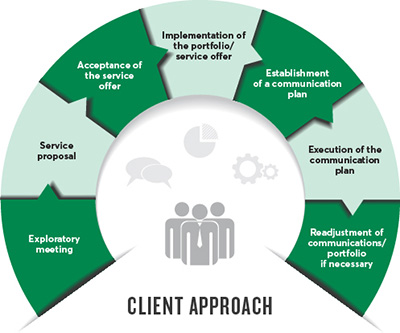

Client approach

- Exploratory meeting

- Service proposal

- Acceptance of the service offer

- Implementation of the portfolio/service offer

- Establishment of a communication plan

- Execution of the communication plan

- Readjusment of communications/portfolio if necessary

First, we’ll make sure we have a proper understanding of your needs and values, your investment horizon and your risk tolerance.

Second, we’ll develop a personalized strategy aimed at meeting your short-, medium- and long-term needs. Then we’ll review the strategy together with you before implementing it. This strategy may include assistance from our in-house partners in creating a detailed financial plan, in estate, tax and trust planning, in transferring a business or taking out insurance. Finally, we’ll set up a communication plan that works for you to ensure that your plan continues to reflect your evolving needs and lifestyle.

We structure portfolios through a Core-Satellite investing approach. The portfolio’s core generally consists of a private pool or a group of mutual funds that give the client total market exposure. The satellites supplement the portfolio’s core and may also boost returns. Finally, we carry out an ESG (environmental, social and governance) assessment of issuers. This approach ensures effective portfolio management, sound risk management and excellent diversification while also offering attractive returns and competitive fees.