Investment philosophy

Our investment philosophy is based on sound diversification among all asset categories and according to different investor profiles.

Our goal is to provide a steady and predictable stream of income enabling our clients to remain financially independent despite market fluctuations.

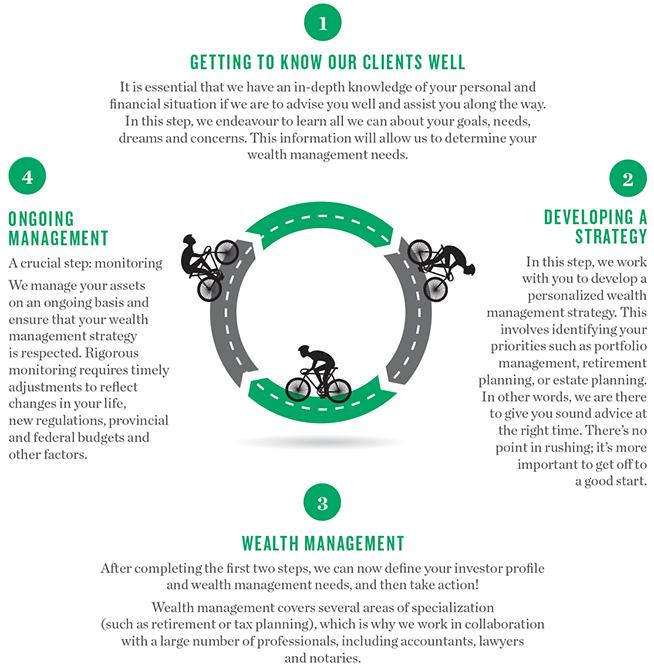

- Step 1 - Getting to know our clients well

It is essential that we have an in-depth knowledge of your personal and financial situation if we are to advise you well and assist you along the way. In this step, we endeavour to learn all we can about your goals, needs, dreams and concerns. This information will allow us to determine your wealth management needs.

- Step 2 - Developing a strategy

In this step, we work with you to develop a personalized wealth management strategy. This involves indentifying your priorities such as portfolio management, retirement planning, or estate planning. In other words we are there to give you strong advice at the right time. There's no point in rushing; it's more important to get off to a good start.

- Step 3 - Wealth management

After completing the first two steps, we can now define your investor profile and wealth management needs, and then take action!

Wealth management covers several areas of specialization (such as retirement or tax planning), which is why we work in collaboration with a large number of profesionnals, including accountants, lawyers and notaries.

- Step 4 - Ongoing management

A crucial step: monitoring

We manage your assets on an ongoing basis and ensure that your wealth management strategy is respected. Rigorous monitoring requires timely adjustments to reflect changes in your life, new regulations, provincial and federal budgets and other factors.

Our investment process

- READING, RESEARCH AND ANALYSIS

- Reading and conducting research (macroeconomic and sector-based studies, specific research reports, Desjardins material and other, external sources of information)

- Identifying the stage in the economic cycle

- Forming an opinion on the markets, asset categories to favour, geographic zones and activity sectors to select, and interest rate and exchange rate outlooks, etc.

- SELECTING INVESTMENT VEHICLES FROM OUR PREFERED SECURITIES

- Identifying investments from our prefered securities that are best suited to the outlooks identified in step 1

- Analysis investment vehicles, company stocks and their results

- Identifying catalysts in these companies

- RISK MANAGEMENT

- Applying our diversification principles to asset categories and geographic and sector-based distribution

- Evaluating the correlation between the investment vehicles selected and their volatility

- Applying our diversification principles to avoid a concentration in certain sectors

- ACTIVE MANAGEMENT AND ONGOING MONITORING

- Ongoing reading and macroeconomic research

- Making adjustments based on our opinion and perspective

- Monitoring the investment vehicles selected as well as those present in our preferred securities (company results)

- Rebalancing and making buy/sell decisions