2022 Year-end Review

Hello everyone,

2022

We are finally turning the page on a difficult year for all investors. Both in terms of equities and fixed income, 2022 provided disappointing returns. We have to go back to the 1970s to see stocks and bonds correcting simultaneously with this level of magnitude. Looking even further, similar events have only occurred three times since 1926, out of a total of 27 stock market corrections. Safe to say, it’s been an exceptional year.

Inflation

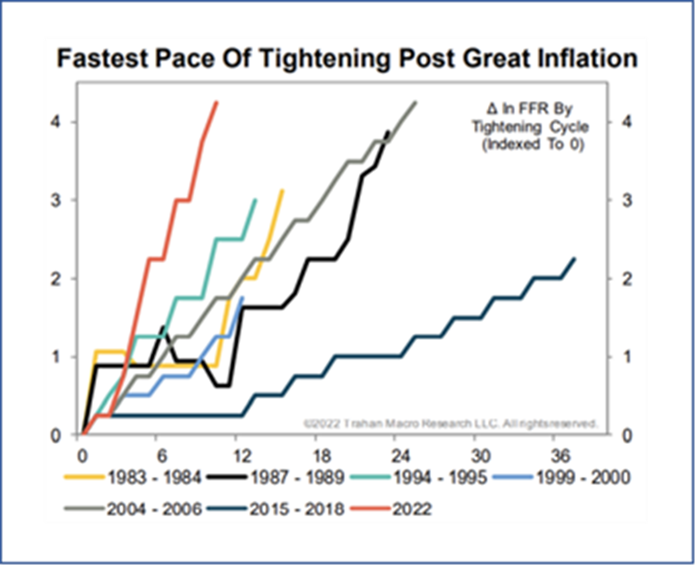

While 2022 heralded a lull in goods inflation, the military conflict on Europe’s front steps boosted inflation, while several commodities (oil, natural gas, agricultural commodities) were pushed to new heights. Facing a fire that is growing rather than dousing, monetary authorities stepped in and initiated the fastest and most robust monetary tightening in over 50 years (see Chart 1)! With financial markets the way they are, rising interest rates have not only generated losses to bonds, but also to equity markets. The good news, however, is that inflation seems to have peaked. In the majority of developed countries, inflation is on a downward slope, which bodes well for the central bank’s actions in 2023.

The Bank of Canada increased its key rate 7 times in 2022, going from 0.25% in January 2022 to a dizzying 4.25% by year end. We have seen the impact on the financial and the borrowing markets as well. Mortgage loans and lines of credit rates are at decade highs. This rapid increase in rates will put a brake on consumption with the ultimate aim of lowering inflation.

Global Market Performance

Canada (S&P/TSX): -5.75%

United States (S&P500): -18.13%

International (MSCI EAFE): -13.92%

Emerging Markets (MSCI EM): -19.94%

Canadian Bonds: -11.70%

Sector breakdowns explain most of the differences in performance on the global stock markets. The strong rise in commodities proved particularly beneficial for the stock exchanges of Brazil, Canada and Australia compared to the rest of the world. Despite a lacklustre economic environment, England, overweight in defensive sectors, also outperformed its global peers. Conversely, lower weighting to technology and interest rate sensitive sectors added to the outperformance of Canada, England, Brazil and Australia.

With its decline of -5.75% in 2022, the TSX did well compared to most foreign stock exchanges, including a fall of -18.13% for the S&P 500, -32.51% for the Nasdaq, -12.4% for the German DAX and -19.94% for the MSCI Emerging Countries index. The relatively good performance of the flagship Canadian index, however, shows very large sector differences. While tech (-52.02%) and healthcare (-61.59%) were particularly weak, consumer staples (+10.08%) and energy (+30.86%) were the only ones with positive contributions!

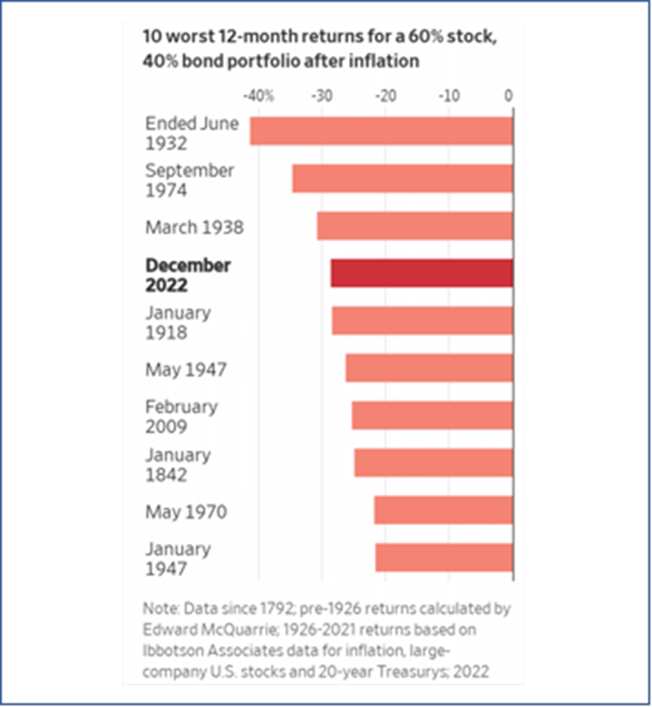

Even balanced portfolios had a dreadful year. The simultaneous loss on the stock and bond side resulted in the fourth worst 12-month performance for a portfolio comprised of 60% US stocks and 40% US bonds! Only 1932, 1938 and 1974 (Chart 2) showed worse results for such an allocation. Equivalent Canadian profiles fared slightly better without, however, managing to generate any gains.

With a decline of -11.70% in 2022, the bond market had its worst performance ever. Moreover, this is the first time that the market has experienced two consecutive negative years. In other words, fixed income is providing great investment opportunities now that rates are up 350%. With this information in mind, diversification remains a major aspect in portfolio construction.

International and Emerging Markets

Geopolitical tensions have particularly affected the international market. The drop in trade and the high uncertainty about Russia caused a sharp decline in these markets. China's "Zero-COVID" policy has also been felt as a major factor, in Asia, internationally, and in North America. China remains Europe’s largest trade partner and as supply chains were almost completely closed, economic activity suffered greatly. Not to mention the sharp rise in the price of commodities (particularly natural gas), which weakened consumer and business confidence.

Fortunately, 2023 is off to a strong start in that part of the world. The abolition of the “Zero-COVID” policy and stronger than expected consumer demand have helped to increase potential returns, so much so that analysts at Goldman Sachs no longer forecast a recession for the euro zone this year. A very encouraging turnaround from last fall.

Looking to 2023

The global economy has yet to fully feel the effects of the aggressive interest rate hikes enacted in 2022. These will continue to weigh on economic activity and risk assets in 2023, and will particularly hit the interest rate sensitive sectors. Hard enough, in our view, to push many of the major advanced economies into recession. This continued tightening will increasingly weigh on global economic activity and risk assets in 2023. But let’s not forget that this is all done on purpose. The correction in the economy and financial markets that we are currently experiencing is the expected consequence of the tightening of monetary policy. This is likely the most anticipated recession in decades.

When inflation and wage growth begin to slow, consumer and business inflation expectations should also decline. Central banks will rely on this trio of indicators to first halt rate hikes and release the figurative economic brakes. We expect to see all of this materialize in the second half of 2023, prompting central banks in major advanced economies to cut their respective policy rates before the end of the year. Of course, the markets will anticipate all of this. In fact, long-term bond yields have already moved above their recent highs, with central banks closing in on their final rate targets.

Final Word

As the global economy begins to recover and growth is reflected in expected earnings, returns on risky assets should also rebound. We expect this will result in a positive return for these assets by the end of 2023 – although they will experience further difficulties by then – and an even stronger recovery in 2024! In short, like 2022, 2023 will eventually pass and will offer its share of opportunities!

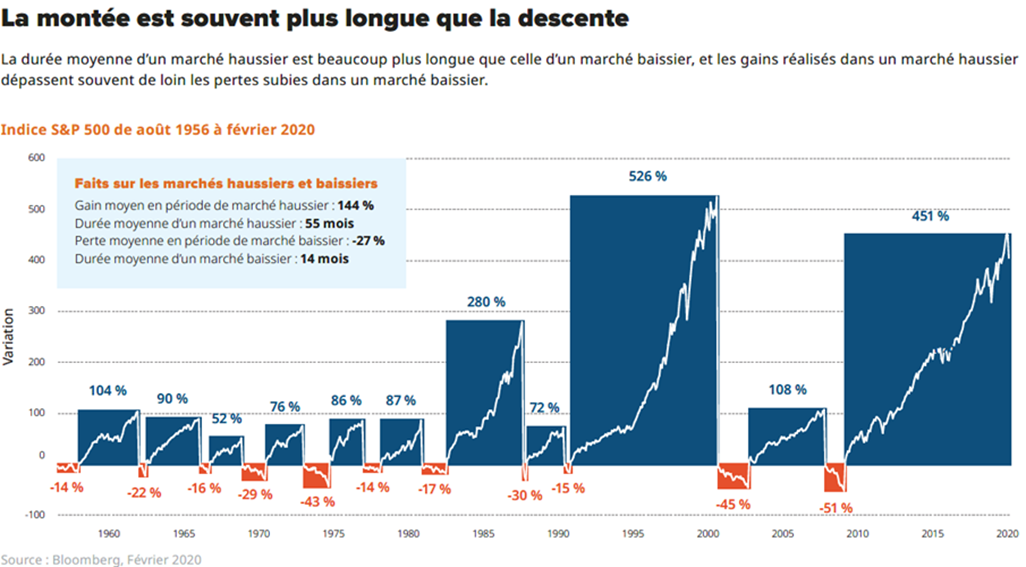

Despite all the short-term uncertainty, the potential for investors with a sufficiently long horizon is much more attractive than at the start of 2022! And we must not forget that following any bear market, there is a bull market, which lasts, historically, 4 times longer (see graph 3).

Graph 1 – Fastest Pace of Tightening in over 50 years

Graph 2 – Worst 12-month returns for a 60/40 balanced portfolio.

Graph 3 – The Ride Up Is Usually Bigger Than The Ride Down

Each Desjardins Securities advisor named on the front page of this document, or at the beginning of any subsection hereof, hereby certifies that the recommendations and opinions expressed herein accurately reflect such advisor’s personal views about the company and securities that are the subject of this publication and all other companies and securities mentioned in this publication that are covered by such advisor. Desjardins Securities may have previously published other opinions, including ones contrary to those expressed herein. Such opinions reflect the different points of view, assumptions and analysis methods of the advisors who authored them. Before making an investment decision on the basis of any recommendation made in this document, the recipient should consider whether such recommendation is appropriate, given the recipient’s particular investment needs, objectives and financial circumstances.