Our Wealth management

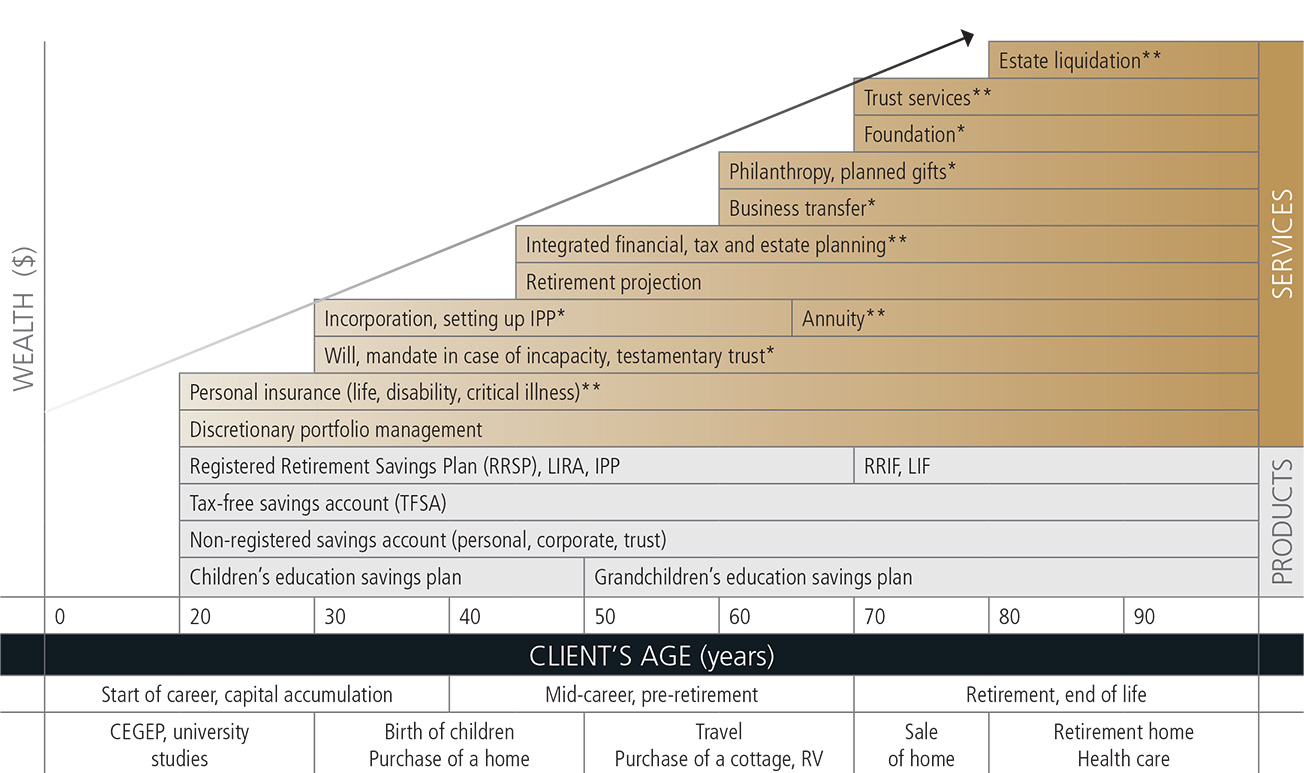

Wealth management tailored to the life cycle

Our role is to advise you by working hand in hand with the best experts (lawyers, accountants, notaries, tax specialists, insurance experts) and with our colleagues in the Caisses Desjardins network (banking services, loans, credit) in order to offer you integrated wealth management services.

Our management approach keeps pace with your life cycle and follows the key stages of life: studies, various career stages, capital accumulation period, pre-retirement, and retirement. It is also adjusted to accommodate the major events that can cause your wealth to fluctuate, such as CEGEP and university studies, the birth of children, the purchase of a home, travel, the purchase of a cottage or recreational vehicle, living in a retirement home, and elder health care.

*Services offered through external professionals.

*Services offered through external professionals.

** Services offered through Desjardins Securities Financial Services.

Ages 20 to 30

Period of life corresponding to the start of a career and capital accumulation, and to the end of CEGEP and university studies.

We offer the following products and services:

- Personal insurance (life, disability, and critical illness) (offered through Desjardins Securities Financial Services)

- Discretionary portfolio management

- Registered Retirement Savings Plan (RRSP), LIRA, IPP

- Tax-free savings account (TFSA)

- Non-registered savings account (personal, corporate, and trust)

- Children’s education savings plan

Ages 30 to 45

Period of life corresponding to mid- career and capital accumulation, the birth of children, and the purchase of a home.

We offer the following products and services:

- Incorporation and setting up an IPP (services offered through external professionals)

- Assistance in preparing wills, mandates in case of incapacity, and testamentary trusts (services offered through external professionals)

- Personal insurance (life, disability, and critical illness) (offered through Desjardins Securities Financial Services)

- Discretionary portfolio management

- Registered Retirement Savings Plan (RRSP), LIRA, IPP

- Tax-free savings account (TFSA)

- Non-registered savings account (personal, corporate, and trust)

- Children’s education savings plan

Ages 45 to 60

Period of life corresponding to mid-career, pre-retirement, travel, the purchase of a cottage or a recreational vehicle.

We offer the following products and services:

- Integrated financial, tax, and estate planning (services offered through Desjardins Securities Financial Services)

- Retirement projection

- Incorporation and setting up an IPP (services offered through external professionals)

- Assistance in preparing wills, mandates in case of incapacity, and testamentary trusts (services offered through external professionals)

- Personal insurance (life, disability, and critical illness) (services offered through Desjardins Securities Financial Services)

- Discretionary portfolio management

- Registered Retirement Savings Plan (RRSP), LIRA, IPP

- Tax-free savings account (TFSA)

- Non-registered savings account (personal, corporate, and trust)

- Children’s education savings plan

Ages 60 to 65

Period of life corresponding to mid-career, pre-retirement, travel, the purchase of a cottage or recreational vehicle.

We offer the following products and services:

- Philanthropy and planned gifts (services offered through external professionals)

- Business transfers (a service offered through external professionals)

- Integrated financial, tax, and estate planning (services offered through Desjardins Securities Financial Services)

- Retirement projection

- Incorporation and setting up an IPP (services offered through external professionals)

- Assistance in preparing wills, mandates in case of incapacity, and testamentary trusts (services offered through external professionals)

- Personal insurance (life, disability, and critical illness) (offered through Desjardins Securities Financial Services)

- Discretionary portfolio management

- Registered Retirement Savings Plan (RRSP), LIRA, IPP

- Tax-free savings account (TFSA)

- Non-registered savings account (personal, corporate, and trust)

- Grandchildren’s education savings plan

Ages 65 to 70

Period of life corresponding to mid-career, pre-retirement, travel, the purchase of a cottage or recreational vehicle.

We offer the following products and services:

- Philanthropy and planned gifts (services offered through external professionals)

- Business transfers (a service offered through external professionals)

- Integrated financial, tax, and estate planning (services offered through Desjardins Securities Financial Services)

- Retirement projection

- Setting up an annuity (a service offered through Desjardins Securities Financial Services)

- Assistance in preparing wills, mandates in case of incapacity, and testamentary trusts (services offered through external professionals)

- Personal insurance (life, disability, and critical illness) (offered through Desjardins Securities Financial Services)

- Discretionary portfolio management

- Registered Retirement Savings Plan (RRSP), LIRA, IPP

- Tax-free savings account (TFSA)

- Non-registered savings account (personal, corporate, and trust)

- Grandchildren’s education savings plan

Ages 70 to 80

Period of life corresponding to retirement or end of life, the sale of a residence, etc.

We offer the following products and services:

- Trust services (offered through Desjardins Securities Financial Services)

- Setting up a foundation (a service offered through external professionals)

- Philanthropy and planned gifts (services offered through external professionals)

- Business transfers (a service offered through external professionals)

- Integrated financial, tax, and estate planning (services offered through Desjardins Securities Financial Services)

- Retirement projection

- Setting up an annuity (a service offered through Desjardins Securities Financial Services)

- Assistance in preparing wills, mandates in case of incapacity, and testamentary trusts (services offered through external professionals)

- Personal insurance (life, disability, and critical illness) (offered through Desjardins Securities Financial Services)

- Discretionary portfolio management

- RRIF, LIF

- Tax-free savings account (TFSA)

- Non-registered savings account (personal, corporate, and trust)

- Grandchildren’s education savings plan

Ages 80 and over

Period of life corresponding to retirement, end of life, living in a retirement home, and health care expenses.

We offer the following products and services:

- Estate liquidation (a service offered through Desjardins Securities Financial Services)

- Trust services (offered through Desjardins Securities Financial Services)

- Setting up a foundation (a service offered through external professionals)

- Philanthropy and planned gifts (services offered through external professionals)

- Business transfers (a service offered through external professionals)

- Integrated financial, tax, and estate planning (services offered through Desjardins Securities Financial Services)

- Retirement projection

- Setting up an annuity (a service offered through Desjardins Securities Financial Services)

- Assistance in preparing wills, mandates in case of incapacity, and testamentary trusts (services offered through external professionals)

- Personal insurance (life, disability, and critical illness) (offered through Desjardins Securities Financial Services)

- Discretionary portfolio management

- RRIF, LIF

- Tax-free savings account (TFSA)

- Non-registered saving account (personal, corporate, and trust)

- Grandchildren’s education savings plan

We also offer the services of certified professionalsFootnote 1 such as tax experts, accountants, actuaries, lawyers, notaries, appraisers and others.

Other services are available through the Caisses Desjardins network, including banking transactions, loans, and credit cards.

We can also work with your own professional resources.

Our investment philosophy

A strict methodology for an optimal return: we have a game plan and we stick to it.

Our investment convictions, which we regard as guiding principles, can be summarized as follows:

- A strict methodology

- Use of exchange-traded funds

- Active risk management

- Diversification

- Cost reduction (tax management and efficiency)

Our rigorous management method is based on the use of exchange-traded funds, which helps reduce risk. These funds enable us to accurately target and manage their geographic and sector allocation according to our macroeconomic analysis, and to rebalance the portfolio at regular intervals. In addition, the management fees for exchange-traded funds are low, which helps increase the return.

Minimizing risk and avoiding emotional decisions

Our rigorous management through the use of exchange-traded funds enables us to avoid emotional decisions and reduce the risk exposure of the portfolios entrusted to us. The frank discussions we have with our clients concerning their financial situation and their concerns create a healthy climate of dialogue characterized by trust and transparency.

Sincerity in words and actions: that is our investment philosophy.

Our investment process

Step 1

Data analysis presented to investment comittee for a consensus

Step 2

- STRATEGIC allocation of the portfolios assets

- TACTICAL allocation of the portfolios assets

Step 3

Model Portfolios:

Conservative, Balanced, Growth, Dynamic Growth

Step 4

Geographic and sector data analysis

CORE positions: high exposure to an asset class

SATELLITE positions: sector or targeted exposure

The geographic and sector data analysis is also presented to the investment committee to obtain consensus.

Last step

Selection of exchange-traded funds based on the model portfolios identified

Our investment process starts with an analysis of your financial data, investment policy, and investor profile in order to reach a consensus on the best strategy for you.

This is followed by the strategic and tactical allocation of your assets within the portfolio that best suits your profile (Conservative, Balanced, Growth, or Dynamic Growth).

Your assets are allocated on the basis of the results of our geographic and sector data analysis, among other things. Two types of positions can be adopted here: the CORE position, implying higher exposure to an asset class; and the SATELLITE position, representing sector or more targeted exposure.

Through sound asset diversification, we will also select the exchange-traded funds corresponding to your profile.

Research sources: Desjardins, Economic Studies, Bank Credit Analyst (BCA), Vanguard Investments Canada, Credit Suisse, BlackRock, MRB Partners.

Our compensation method

Our preferred compensation method is a monthly fee calculated on a sliding scale, based on the amount of assets under management. As your assets grow, the fee rate decreases. That’s why it is beneficial to combine your account with those of your family members.

Fees for non-registered accounts are tax-deductible.

Transaction-based pricing is also available, on request.